Coca-Cola Consolidated: Should you Buy the Bottler?

Coke Consolidated manufactures and distributes Coca-Cola products and beverages from other companies.

This is the second part to another article I wrote.

First Article:

Company Overview

Coca-Cola Consolidated, although affiliated with Coca-Cola, bottles a variety of beverages in the United States. In fact, it is the largest Coca-Cola beverage bottler in the U.S. Its beverage portfolio include: Coca-Cola, Sprite, Fanta, Dasani, Powerade, Body Armor, Minute Maid, Simply Beverages, Monster, Gold Peak tea, Fair Life, and many others.

The company makes the drinks in their facilities. Beverage companies, like Coca-Cola, ship Coca-Cola Consolidated their syrup. Then, Coca-Cola Consolidated makes the beverage.

The company also acts as a distributer for their beverage clientele, distributing the products to restaurants, stores, vending machines, and other outlets for beverage purchasing. As such, Coca-Cola Consolidated controls much of the logistics of these beverages, with many of them not being owned or manufactured by Coca-Cola.

Recent Earnings

The most recent quarterly earnings report from Coca-Cola Consolidated is for the third quarter. In the Q3 2024, net sales, gross profit, and income from operations increased. However, the company’s product volume decreased.

The most notable increase in Q3 2024 report is the first nine months comparison for 2023 and 2024. When the first 9 months are compared, income from operations increased 7% in the first 9 months of 2024 when compared with the same time in 2023.

Guidance

Coca-Cola Consolidated is currently anticipating a 2% sales increase in 2025. According to the forecast, the company’s revenue should increase $135.68m, putting total revenue at $6.92b.

The company is also aiming to increase their EBITDA margin. Their current margin is 15.5%, and they currently hope to achieve a margin of 16% or above in 1 to 2 years.

Market Control

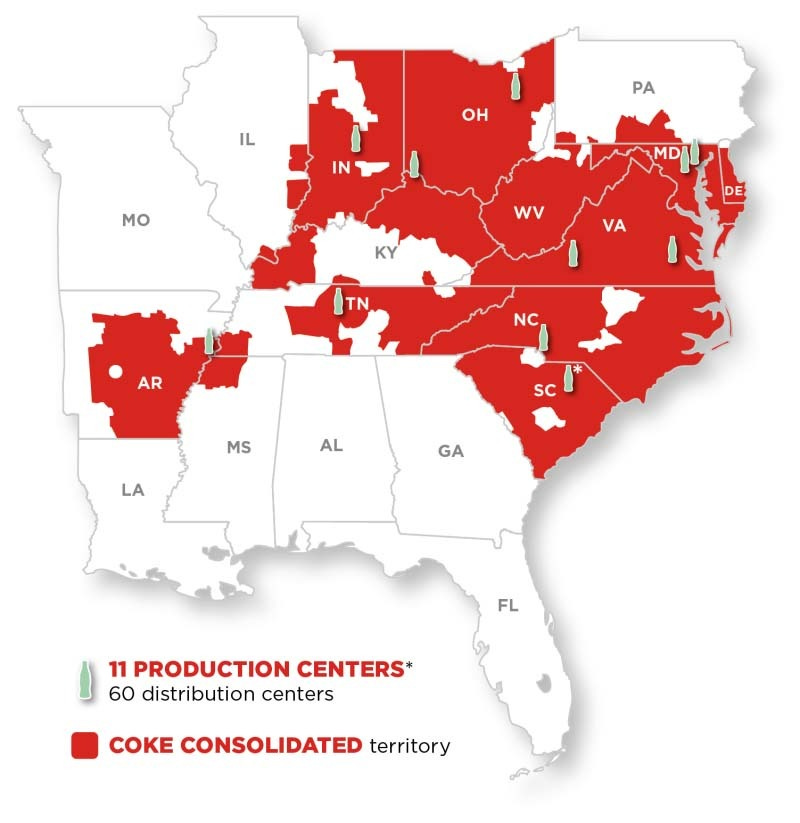

As mentioned before, Coca-Cola consolidated is the largest Coca-Cola beverage bottler in the United States. Their territory includes much of the Midwest, South, and parts of the East coast.

Other Coca-Cola beverage bottlers in the United States control much less territory. For instance, the second largest bottler is Coca-Cola Bottling Company United. Their territory is Georgia, Louisiana, Alabama, and parts of Mississippi.

In the past year, the company began making and distributing Bang Energy. Bang Energy is currently a subsidiary of Monster Energy, the second largest energy drink company in the United States. Monster Energy is in a partnership with Coca-Cola.

Recently, Coke Consolidated has also opened two new facilities: one in Columbus, Ohio and one in Monroe, North Carolina.

Stock Buyback and Dividends

In August, the company’s executives decided to approve a $1 billion common stock buyback program. Stock buybacks are usually a good sign that a company believes they anticipate future gains. Along with that, buybacks also increase stock price.

“As we’ve previously stated, the progress we’ve made improving our profitability and strengthening our balance sheet allows us to reinvest in our business and our teammates while taking steps to build long-term value for our stockholders,” said J. Frank Harrison, III, Chairman and Chief Executive Officer. “Our strong financial performance supports increasing our quarterly dividend and establishing a share repurchase program, which aligns with our commitment to return cash to our stockholders over time.”

Coca-Cola Consolidated Press Release

Coke Consolidated, earlier in the year, established a different buyback program aimed to regain shares that were owned by subsidiaries of Coca-Cola, like Carolina Coca-Cola Bottling Investments. The deal to buyback shares totaled to $553.7 million.

In the same announcement as the buyback, the company increased the dividend by 5x, from $0.50 each quarter to $2.50 quarterly. The dividend yield is now 0.81%.

Conclusion

Coca-Cola Consolidated just has such a grip on the market for bottling and distributing. Most of the drinks you buy in the grocery store, or consume at a restaurant, move through Coca-Cola Consolidated, especially if you live in the Midwest.

Coca-Cola Consolidated has experienced rapid growth in the past couple of years, with expansions by building new facilities and expanding into Kentucky. The company executives must also anticipate future growth, as shown with the capital they are pouring into stock buybacks.

With Coca-Cola Consolidated’s position in the market, and being the only Coca-Cola bottler in the U.S. to be a public company, the stock is an amazing addition to someone’s portfolio. This is one of the few companies that almost always has a good, guaranteed, revenue and profit.

I believe that Coca-Cola Consolidated is a Strong Buy.