A Foreword for a Tariffed World

We are moving into relatively uncharted territory and no one is reacting as they should.

What is Going On?

A lot.

Honestly, it is hard to pin down everything that has happened, is happening, and is about to happen. However, there are several key things we can pin down:

Trump’s “Reciprocal” Tariffs

China’s Reciprocal Tariffs

Unclear information regarding tariffs

US Bureaucrats Resigning

Jerome Powell & Interest Rates

In the below sections, I will go into each topic more in-depth.

Here’s a previous article I wrote that I would recommend reading along with this:

Trump’s “Reciprocal” Tariffs

Trump launched reciprocal tariffs on countries and economic unions around the world, most notably the EU, Japan, Taiwan, and China. It was, at first, unknown how Trump and his economic team calculated the effective tariff rate from each country — well, at least for a few hours.

Then, people, quite simply, cracked the equation that the White House’s economics team used.

Well, this looks fancy, doesn’t it? It’s complex exterior is all the equation has going for it. Let’s break it down:

Xi is exports that the US has to selected country. Mi is the imports the US receives from selected country. That’s really it. So you are probably asking was are the other two Greek letters. Pinterest decorations, in essence.

One Greek letter equals 4 and the other equals 0.25, which cancels each other out. If this equation was presented in any credible class, the student would be docked points for not simplifying.

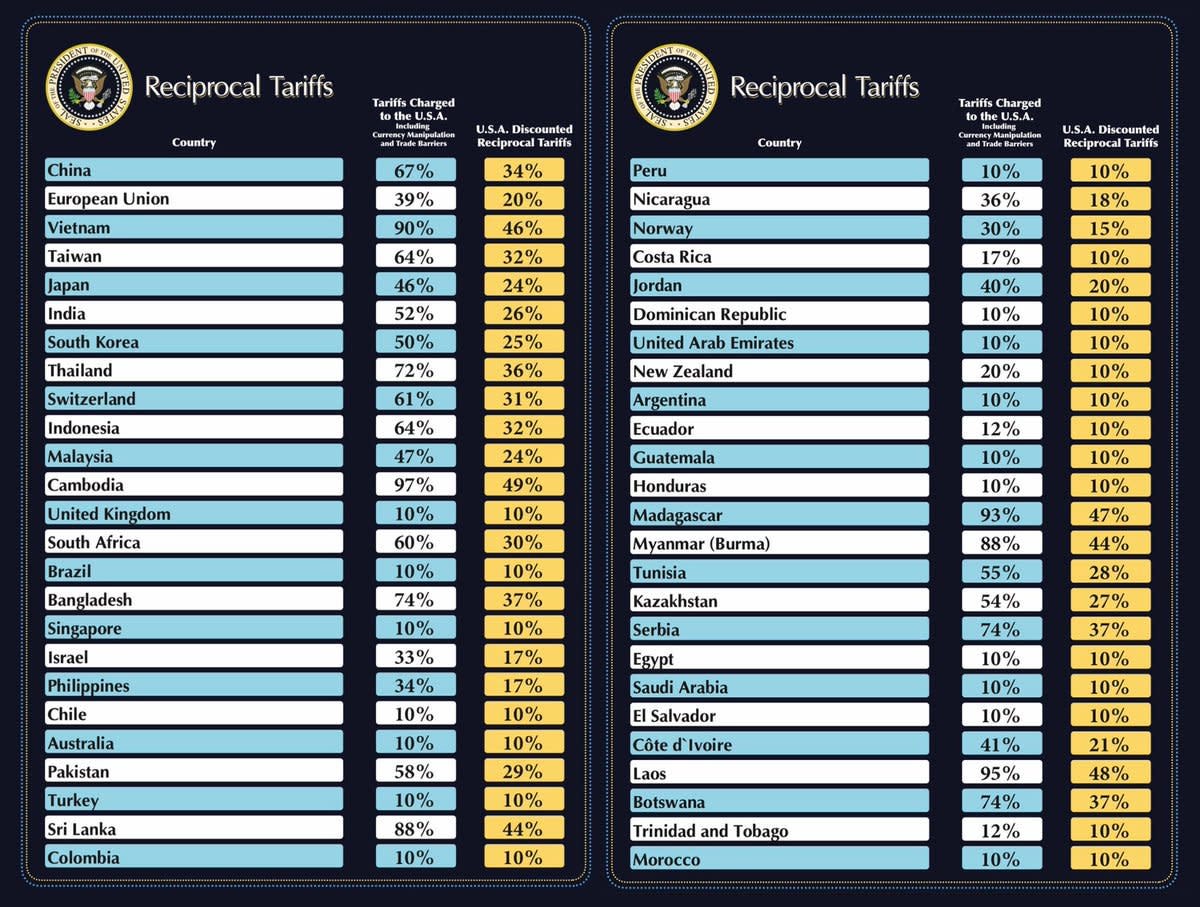

So then what tariffs were applied to every country? Well, here’s the chart that was presented during Trump’s speech:

Just to remind you, these aren’t the actual tariffs or trade restrictions applied to the United States by these countries — this is just the White House’s trade deficit equation halved.

Then, with countries the US has a trade surplus, they still plan to apply a 10% blanket tariff on them.

The announcement of these tariffs led to one of the largest selloffs of the US — and global — markets, falling roughly ~10% in a 3-day period.

Currently, the tariffs are planned to go into effect today, Wednesday, April 9th.

China’s Reciprocal Tariffs

Then, it has also been announced that the US is going to tack on another 50% tariff on China in response to China’s response on tariffs, which will bring the total tariff rate to 104%.

I will return to the effects of this in my conclusion.

After the US announced tariffs on China, China announced tariffs in response. This has led to the US to tacking on more tariffs as well, kicking off the largest trade war in over a century.

Unclear Information Involving Tariffs

Yesterday, if you were watching the US markets, you would have noticed that indices went drastically up, then fell back down. This was due to a false tweet that stated tariffs would be paused.

This tweet got picked up by CNBC, which then led to investors buying in the market for the next half hour. Then, it was announced by the White House that the tweet was false and they were going to continue the tariffs on Wednesday, pushing the market back down.

Bureaucrats Resigning

Last night, many executives in the IRS resigned. This includes the commissioner, Melanie Krause, CFO Teresa Hunter, and CPO Kathleen Walters.

Treasury Dept. official David Lebryk resigned due to DOGE’s invasiveness in governmental records.

Director of FDA’s food division, Jim Jones, resigned due to cuts to his division, which made his job much harder.

Top FDA vaccine official, Dr. Peter Marks, also resigned due to RFK Jr.’s management of Health and Human Services.

Jerome Powell & Interest Rates

During the last Fed meeting, Jerome Powell announced a wait-and-see measure for interest rates, not wanting to make a move yet until more data comes.

With tariffs looming and the White House’s unclear economic policy, Powell and the Fed didn’t believe they could make an accurate assessment of whether or not to cut interest rates.

Conclusion

The market is going to continue to dip. We haven’t seen this level of tariffs for over a century. This is at the same level of the Smoot-Hawley tariffs, which Congress passed in an attempt to save the US economy from the Great Depression. However, the tariff act pushed the US economy deeper and faster into the depression.

It is hard to truly quantify how much the tariffs will hurt the US and the global markets.

Here’s my inflation projection:

1-4 months we will see higher inflation

After that, we will see inflation drop drastically to below 2%, then we will have deflation.

Consumer confidence is going to continue to tank, and no one is going to buy anything. Oddly enough, America may become a society of savers after they are done with tariffs.

Here’s my interest rate projection:

Interest rates will drop faster and further than the Fed has been projecting. Instead of two quarter-point drops, we will see 3-4 half-point drops in the twelve-month period.

Here’s my GDP projection:

By the end of 2025, the United States and much of the world will be in a recession. The US GDP will probably see a GDP drop of -1% to -2% by the end of 2025, and another -2% to -3% drop in 2026.

My long-term analysis:

It’s not good, especially if you are American. Trump is idealizing having hard manufacturing return to the United States, and for the most part it isn’t a part of America culturally.

Americans don’t want to assemble iPhones, they want to design iPhones.

Trump will have the lowest approval rating in the history of US presidents, and he will fall out of grace of many of his constituents and voter base. Democrats will win the midterm in 2026.

Tariffs will probably get contested in Congress by the 3rd quarter of 2025. I doubt it will happen sooner due to the time it takes for Congress to find a backbone.

Stock Market Analysis:

Don’t buy the dip.

For the love of everything, don’t buy the dip right now.

At least wait one month. Investors and people alike have not seen a trade war or tariffs among major countries like this ever.

I see the S&P falling in the range of -20% to -35% this year and the NASDAQ falling -25% to -35% this year.

Unless you are DCA-ing from an already expensive average cost, then you should you some cash to buy the dip.

This is not financial advice. This is for entertainment and informational purposes only. All opinions expressed here are my own and are subject to change without notice. Use this information at your own risk.